A few quick facts on the recent growth of the credit union industry, according to CUNA Mutual data:

- Credit union loan balances rose 6.5% in 2019, down from the 9% reported in 2018

- Real estate loan balances grew 9.3% in 2019, the second-fastest pace during the last decade (and only slightly behind the 9.5% pace set back in 2017)

- Savings balances rose 8.2% in 2019, faster than the 6% pace set in 2018.

A Coming Crisis or Opportunity?

Credit unions typically grow during periods of economic expansion, yet often have issues during times of uncertainty. Today is the perfect time for the industry to embrace a more data-driven marketing approach.

Data-led marketing is the engine to grow and combat the financial slow down. Credit unions replace face to face data gathering with automated data gathering and analytics that match member account behaviors with demographics and other lifestyle characteristics.

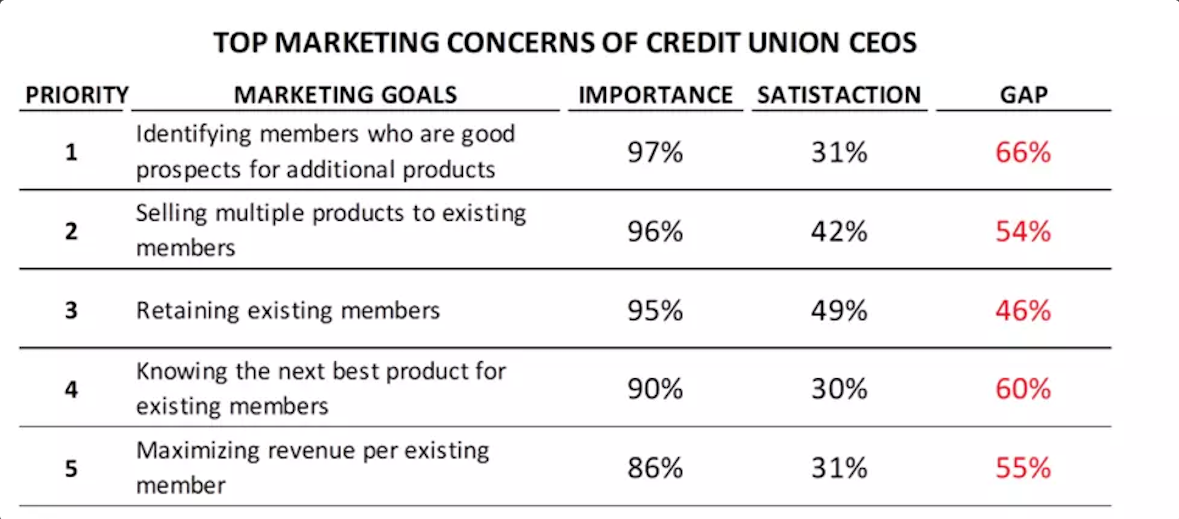

While many credit unions already employ advanced, predictive analytics in some parts of their business, according to a recent study, 45% of credit unions don’t currently have a data and analytics strategy in place. Further, many of the credit unions that claim to have a data-driven approach in place say it will take three to five years to implement. There is a lot of frustration on the part of credit union CEOs trying to build a data-marketing capability.

Credit Unions Can Benefit from a Data-Led Marketing Strategy

The more credit unions embrace digitization, the more opportunities for growth. Credit unions must actively participate in the digital transformation to not just survive – but thrive – in the rapidly changing financial services landscape. With the right analytics tools in place, there are high-impact strategies credit unions can implement within a matter of months.

- Understand and identify your target market. Obtaining more information on members allows credit unions to serve their member’s needs better.

- Better identify risk. Smart credit unions look beyond just credit scores and borrowing/lending history to understand the longer-term results and implications.

- Tailor offerings to members. What types of products and services do your current credit union members need? What kinds of upgrades, changes to terms, conditions on accounts, or features in loans matter the most to customers? Data answers these questions.

- Recognize Trigger points. Data-led insights can help credit unions understand why members invest and learn what makes interested investors buy.

- Holistic member understanding. Once a credit union masters the basics of using first-party, transactional data, a credit union can improve marketing by layering on third-party data from a trusted source. Combing data sources offers a more holistic understanding of member needs, wants, lifestyles, and motivations.

The Bottom Line for Credit Unions

Credit union leaders need to acknowledge the necessity for investing in the development of a data-led marketing capability. Credit unions not currently adept at using member data must develop an implementation strategy and road map based on the reality of available resources.

Whether large or small, credit unions can find success by starting small. Get your hands-dirty with member data to unearth quick wins that will help drive longer-term buy-in. Seeking out a partner like Response Media adept at bringing data-led marketing strategies to credit unions can accelerate results, too.